As there is continued debate and effects on free services promised by the Karnataka government, a common question that comes to most people’s mind is,

- Why could the government giving free money or services be a problem?

- Isn’t giving free an act of compassion from govt to actually help the people who are at the bottom of the pyramid?

Now the above 2 questions can put most people in the defensive and accept the logic of giving Free is indeed good.

And also there are arguments from some economists that giving free indeed boosts the economy in the long run!

Now let me make an attempt here in this writeup why giving Free beyond means is a recipe for disaster. And it encourages wrong habits.

Because there is a cost to this free and the cost needs to be paid. And the way it has to get paid is what many miss!

Unless one makes some attempt to understand human psychology and economics. Let’s explore

Law of Reciprocity

The reciprocity principle is one of the basic laws of social psychology: It says that in many social situations, we pay back what we received from others.

In other words, any favor received from a person, business, or government, you’re likely to return it back. This can be said to be a sub-set of the Law of Karma.

Now the law of reciprocity is easy to understand but difficult to relate to in most situations. This is what makes many of us get trapped when some things are given for Free.

This law is sort of a mental trigger. This means it can be used to get favorable outcomes from people.

Law of reciprocity which can be used for good or bad.

In business, it is common to provide for free which is valuable to customers so you can build goodwill and also get them to accept your request of meeting or attend a webinar.

The only thing here is what is given for free & what is to be paid back are quite clear. There isn’t any hidden self-interest.

But this law of reciprocity is used often in a more self-interest way where businesses offer things Free without revealing what customers are asked to pay back.

For example, companies like Facebook, allow you to use their services for FREE, but they never tell you, what user must return back.

Or when government promises free power and free money, it is not easy for the common citizen to understand what is that he must pay back.

The allure of receiving benefits without immediate cost seems appealing, but it is important to realize the basic rule of economics is there is no Free Lunch.

The law of reciprocity is so powerful that it will work its course to make each one of us return what is being received!

This complexity comes from, what is received and what is paid back need not be in the same form.

Values Drive Actions

The actions of individuals, organizations, and even the government primarily differ based on the values each hold.

Take the case of social media.

When Facebook offers free content, what is being given in return?

As a free user of Facebook, one wants to use it either to connect with friends or for entertainment, and education.

In exchange for this free content, you trade your time on the platform & also give out your personal details including your interests, and likings, location, etc.

Now folks in Facebook value every detail about users because they can now share details with advertisers who will advertise products and services.

If a user purchases any product, the advertiser makes money which is compensated with a commission paid to Facebook.

This is a simple cycle if you understand.

Where not many get it, there is less transparency about what you are paying back. Facebook never publishes upfront what you are supposed to pay back in terms of the details, and be exposed to customized ads, for the content you can receive for Free.

What you get for Free and what you need to pay back has a time lag. The best-marketed companies build up enough free goodwill that when they make an offer, consumers just can’t resist paying back and buying the product!

How government free services are paid back?

Now let’s explore the much more complex thing that comes with more deception than the organizations.

It is when some politicians promise free schemes that are beyond economic limits.

When the government announces free, it is always to a certain section of people. And this section who are eligible for free, find it difficult to reason of how they are being asked to pay back.

The very fact that more and more people line up for free schemes means, there is a genuine lack of understanding of how payback happens from them as well as the rest of the society.

The common notion is one can have a free ride really!

The finance and money are based on laws similar to gravity laws of physics, and cannot be violated at will.

A few of these laws are,

- It is the supply of goods and services at lower prices that make the economy prosper vs just having more money supply

- There isn’t a free lunch in the economy. Everything needs to be paid back

- The money supply creates inflation and ultimately loses money value

Again these laws are colored by different political views. To understand how policies of subsidized utilities, and free money, when stretched for far affect the economy and in general well-being of society, one must take out the glasses of politics and see through the laws of money and the economy.

The laws of money & finance

Firstly if any government resorts to giving free services to a large working section of society, it means,

Instead of enabling society to earn on their and afford the goods and services they need, the government is giving direct money to fulfill those needs.

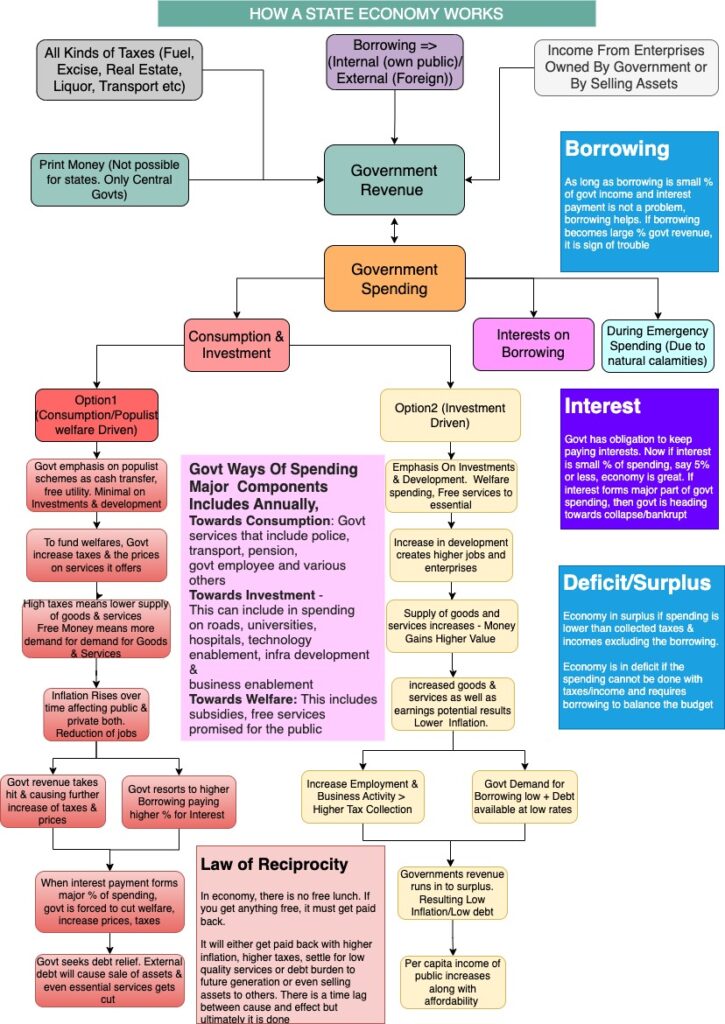

Now to fund this kind of welfare to a large section of the population, it is critical to understand what means the government has in the first place.

The government functioning isn’t much different from the household or running any business. Only what differs is in terms of scale and time periods.

Let me tell you in a simplistic way,

The income side of the government has 3 elements

- Taxes

- Profits from Assets & Services Govt owns

- Borrowing

Spending is again can be divided into 3 elements

- Consumption (To run various services and also for emergencies)

- Investment (In infra, healthcare, education, R&D, and enterprises )

- Interests on borrowing

If you want to understand more you can download this How Govt Finance Works 1-Pager

If the state is having more income than spending, it will accumulate reserves that can fund welfare without much trouble.

But when governments run with deficit, implies spending is more than income, then welfare schemes can be financed only by either increasing taxes, increasing the prices of govt services, and most likely by borrowing.

When a deficit government promotes excess welfare, the actions will result in,

- Fewer funds to invest in developments that impact job creation as well as lower quality services

- Increasing the money supply relative to goods and services results in inflation, which means higher prices for services

Excess money supply diversion to welfare naturally causes higher inflation and low investment results in poor services as well as lower job creation.

By paying higher direct taxes, higher inflation, and settling for poor services, is how the public end up paying back for things received for Free.

The kind of payback differs between different sections of the public.

A section who are wealthy will part through extra taxes, and another section that is economically weaker will pay back through inflation and settle low-quality services.

The illusion that is free.

The law of reciprocity reveals that the concept of receiving something “free” from the government is, in fact, an illusion.

I say illusion because the effect of free schemes has its own time lag.

They are hard to figure out for many if they haven’t experienced them in their own life and heard stories from others.

The lure of what is FREE today masks the future misery

Economies, in which either public or private enterprises are receiving free goods and services from the government are effectively enjoying today the perks from their future selves or burdening future generations to fund these initiatives.

Moreover, the burden of paying back this debt often falls disproportionately on future generations, who have had no say in the decision-making process.

They inherit a weaker economy, reduced opportunities, and the responsibility of repaying the debt incurred by their predecessors.